Online Dual MBA In Banking and Insurance

(Online Dual MBA In Banking and Insurance from Top Universities In India)

Home >> Online MBA >> Online Dual MBA In Banking and Insurance

The banking and insurance sector is gaining increasing popularity. To meet the growing demand for skilled professionals, many reputed online universities offer quality MBA programs in this field. An Online MBA in Banking and Insurance is a two-year postgraduate degree designed to equip students with essential knowledge and practical skills to thrive in the finance industry. Upon successful completion, graduates can pursue roles such as Business Consultant, Insurance Claim Adjuster, Insurance Investigator, Equity Manager, Credit Analyst, Investment Banking Analyst, and Banking Associate. Prospective students can visit the official websites of online universities for detailed information on fees, eligibility, course structure, and more.

- Course Duration: 2 years (24 months)

- Study Mode: 100 % Online

- Accreditation: UGC, WES approved & NAAC accredited

- EMI Options: You’ll have access to budget-friendly payment plans

- Last date of admission: Ongoing

This information is provided for audience reference only. The video has been sourced from YouTube as a free resource. We are not affiliated with the YouTube channel or its creators. The views and opinions expressed in the video are their own. This information is provided for audience reference only.

Admissions for online MBA In Biotechnology programs for the academic year 2025–26 are currently ongoing.

DEB ID is a mandatory unique ID for learners seeking admission in Open and Distance Learning/Online programs from UGC-recognized HEIs. Students can create an ABC ID via Digilocker. For additional precautions, refer to UGC Notice.

Stay updated with all official notifications. Visit the Notice Board at deb.ugc.ac.in for the latest updates on online and distance learning programs.

Learn From Top Ranked Institutes & Universities

Online MBA In Banking and Insurance Course Overview

Several reputed online universities offer MBA programs with a specialization in Banking and Insurance. Although not every university includes this specific stream, top institutions like Shoolini University Online and Amity University Online provide this program. These courses are designed to meet the growing demand for skilled professionals in the banking and insurance sectors. If you’re unsure about which university best suits your needs, you can use an online university comparison tool to evaluate key features, fee structures, and academic benefits to make an informed decision.

Here are some key highlights of Online MBA In Banking and Insurance from Top Colleges/Universities In India

– The Online MBA in Banking and Insurance is a two-year program divided into four semesters.

– It is open to graduates from any academic stream, offering broad eligibility.

– The program is well-suited for working professionals due to its flexible online learning schedule.

– The course fee typically ranges from INR 1,00,000 to 1,50,000, depending on the university.

– It includes online classes, digital study resources, and practical assignments aimed at preparing students for a career in the financial services industry.

Build the Right Skills & Shape Your Future from Our Unbiased Career Counselling. Choose the right path and Get 100 % Unbiased Career Advice.

Claim Your 100% Free Guidance on 100+ Online MBA Universities

UGC/Government Approved Online MBA In Banking and Insurance (Key Highlights 2025)

| Parameter | Details |

| Degree Name | Master of Business Administration (Online) |

| Specialization | Banking and Insurance |

| Course Level | Postgraduate |

| Duration | 2 Years (Flexible up to 4 years) |

| Mode of Learning | 100% Online |

| Eligibility | Bachelor’s Degree (with or without work experience) |

| Admission Process | Merit-Based / Direct / Entrance Exam (only in select institutes) |

| Entrance Exams (If Required) | CAT, XAT, MAT, SNAP, GMAT, or university-specific exams (*Not Mandatory for every university) |

| Fees Range | ₹ 1 Lakh – ₹ 2 Lakhs |

| Teaching Mode | Online Classes + LMS (Learning Management System) |

| Average Salary Post-MBA | ₹8 – ₹15 LPA |

| Top Recruiters | TCS, Infosys, Deloitte, Accenture, ICICI Bank, HDFC, Samsung |

Online MBA Course from Top Universities In India

Amity University Online

MBA Online from Amity University

📍 Noida, Uttar Pradesh

Industry Collaborations

₹ 43,750/- Per Semester

LPU University Online

MBA Online from LPU University

📍 Jalandhar, Punjab

Guest Lectures by Industry Experts

₹ 40,400/- Per Semester

Manipal University Online

MBA Online from Manipal University

📍 Manipal, Karnataka

Google Cloud Computing Curr.

₹ 43,750/- Per Semester

Symbiosis School for Online Learning

MBA Online from Symbiosis

📍 Pune, Maharashtra

Live class interactions

₹ 78,750/- Per Semester

Manav Rachna Online Learning

MBA Online from Manav Rachna

📍 Faridabad, Haryana

Micrsoft Certifications

₹ 41,999/- Per Semester

Indira Gandhi Open University MBA Online from IGNOU

📍 Maidan Garhi, New Delhi

Affordable Fees Structure

₹ 16,000/- Per Semester

Online MBA In Banking and Insurance Duration & Eligibility 2025

Eligibility (Graduation or its equivalent): To be eligible for this program, applicants must have completed their graduation (10+2+3) from a UGC-recognized university. A minimum aggregate score of 50% (not mandatory for all online universities) is typically required. The course is also open to working professionals who wish to upskill themselves or transition into the banking and insurance domains.

– Applicants must have a bachelor’s degree from a recognized university with 50% marks for general category and 45% for reserved category (Not Mandatory for all online university).

– Entrance exams like CAT, XAT, CMAT, SNAP, MAT, NMAT, ATMA, GMAT are accepted, but not mandatory.

– Work experience is not required, though it can help in better understanding the course content.

– There is no age limit to apply for this program.

– A good command of English is recommended for better comprehension and communication.

Duration (2 Years/24 months): – The minimum duration for the program is 2 years, and students are allowed up to 4 years to complete it.

Other Top MBAs In India & Abroad

Ranking & Approvals

UCG Entitled

Recognized by the University Grants Commission

AICTE Approved

Approved by the All India Council for Technical Education

WES Accredited

World Education System

NAAC A++ Accredited

Accredited by the National Assessment and Accreditation Council

MHRD Approved

Ministry of Human Resource Development

AIU Approved

Recognized by the Association of Indian Universities

Other Popular Online MBA Specializations In 2025

Online universities in India & Abroad offer a variety of MBA specializations to provide students with an in-depth understanding of managerial principles. These institutions offer the following online MBA specializations…

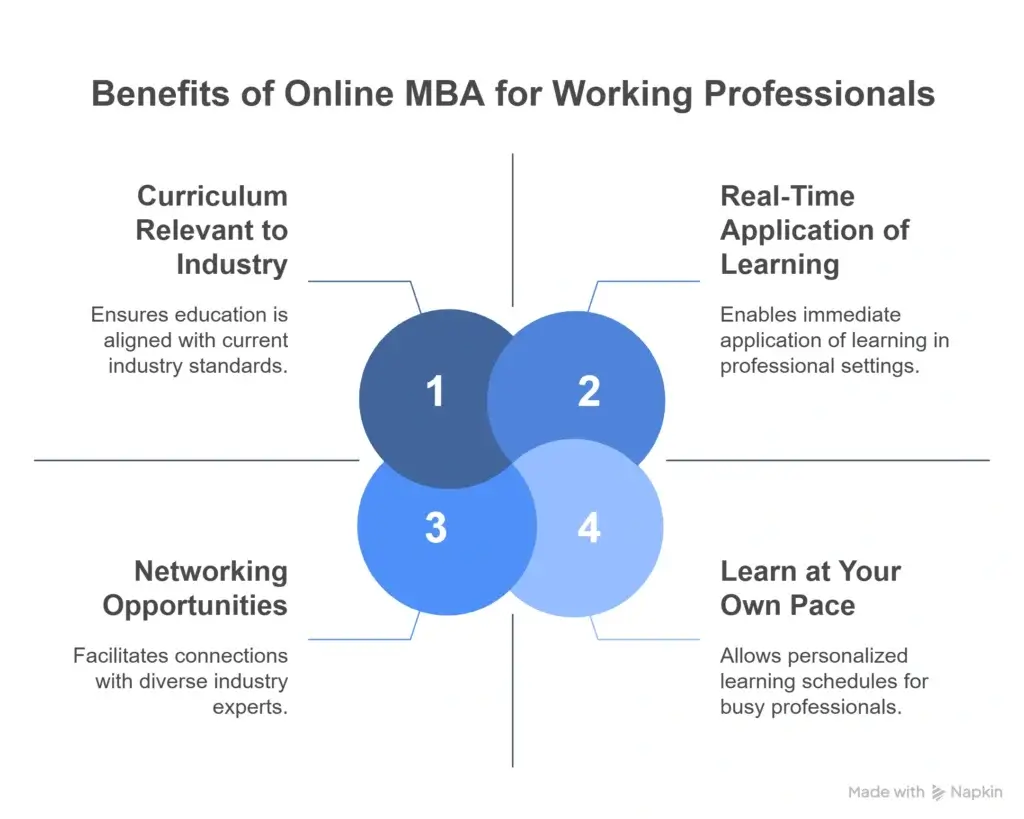

Advantages of Online MBA for Working Professionals

An online MBA offers numerous advantages/Benefits for working professionals seeking to boost their careers without pausing their employment.

– Study at your own pace and schedule (Flexibility), making it easier to balance work, education, and personal life.

– Continue your job while pursuing the degree (Work-Study Balance), allowing you to apply new concepts directly in the workplace.

– Lower overall costs compared to traditional MBA programs (Cost-Effective), with savings on commuting, relocation, and materials.

– Interact with peers (Global Networking), faculty, and industry professionals from around the world, building valuable connections.

– Gain leadership, strategic thinking, and advanced management skills that support career growth.

– Improve your qualifications for promotions, leadership roles, or even career changes without taking a break from work.

Job Roles After MBA Online In Banking and Insurance Degree

ENTRY LEVEL

– Financial Services Executive

– Credit Analyst

– Insurance Advisor

– Banking Associate

– Claims Processing Executive

– Customer Relationship Executive

– Risk Analyst

– Operations Assistant

– Policy Administration Executive

MID LEVEL

– Branch Manager

– Relationship Manager

– Underwriting Manager

– Claims Manager

– Risk & Compliance Manager

– Product Manager

– Operations Manager

– Sales Manager

– Credit Risk Manager

– Training & Development Manager

ADVANCED LEVEL

– Vice President – Banking & Insurance

– Director – Operations

– Head – Risk & Compliance

– Chief Underwriting Officer

– Chief Claims Officer

– Executive Director – Financial Services

– Chief Operating Officer (COO)

– Chief Risk Officer (CRO)

– Chief Marketing Officer (CMO)

– Chief Executive Officer (CEO)

Online MBA In Banking and Insurance Curriculum (Syllabus/Subjects) 2025

This MBA specialization includes a rich and well-organized curriculum spread over four semesters. Key subjects covered in the program include Strategic HR Management, Economic Decision-Making Techniques, Banking Laws and Ethics, Marketing Management, Insurance Operations, and Customer Relationship Management in Financial Services. The combination of these subjects ensures that students acquire both theoretical knowledge and practical insights into the financial services sector.

Online MBA In Banking and Insurance Course Curriculum

24 months | 15-20 hours/week | 2 months /specialization

This course curriculum provides an overview of the MBA in Banking and Insurance. For the updated or university-specific curriculum, click on the button ‘I Want the Updated Syllabus.’ A counselor will connect with you shortly.

Common Course Structure of an Online MBA in Banking and Insurance

- Business, Society, and Law

- Financial Reporting and Analysis

- Leadership & Organization Behavior

- Managerial Economics

- Marketing Management

- People Management

- Consumer Behaviour

- Business Research Methods

- Financial Management

- Operations and Quality Management

- Strategy, Business, and Globalization

- Digital Marketing

- Decision Science

- Merchant Banking & Financial Services

- Legal Aspect of Banking

- Treasury & Risk Management

- Corporate Insurance Management

- Project Management

- Values and Ethics

- Academic Research Writing

- Mutual funds and portfolio management

- Banking & Insurance Management

- Bank Associates

- Career advancement opportunities

- Cost savings

- Financial analysis

- Banking Operations

- Financial reporting

- Strategic Thinking

- Entrepreneurial Mindset

- Global Business perspective

- Heightened leadership skills

- Networking and professional growth

- Risk Management

- Investment Management

- Insurance Management

- Problem-Solving

- Technical-Proficiency

Learning Method ( Online MBA In Banking and Insurance LMS)

E-books & Study Material

View and download study materials, attend virtual classes, and watch pre-recorded lectures.

Live Interactive Sessions

Participate in MBA course online discussion forums, interact with peers, and get support from faculty.

Project & Assignment

Upload assignments of MBA programs and track submission deadlines easily.

Learning Managment

The LMS is accessible anytime, anywhere, ensuring flexibility for working professionals and remote learners.

Renowned Faculty

Apply invaluable insights from renowned academicians from IITs, IIMs and industry veterans to your coursework and enhance your skills.

Worldwide Reach

The Online MBA program offers globally recognized, flexible, and high-quality education tailored for working professionals and modern learners, with credentials that meet both national and international academic standards.

Online MBA In Banking and Insurance Fees Structure & scholarships In 2025

The total fee for the Online MBA in Banking and Insurance is ₹ 60,440* to ₹4,00,000/-. This amount may vary across different universities and generally excludes costs related to registration or semester examinations. Prospective students are advised to visit the official website of the university they wish to apply to, in order to view the detailed and most updated fee structure.

Students can pay the fees as per the available payment options only at university’s official website:

– One-time full payment for the entire program

– Semester-wise payment

– Annual payment

– Easy EMI (installment) options available

Online MBA In Banking and Insurance Admission Process 2025 (How to Apply?)

The admission process for this program is entirely online and user-friendly. Candidates need to visit the official university website, complete the registration form, and pay a nominal registration fee. They must also upload scanned copies of the required documents and proceed to pay the semester fee online. After successful submission, an acknowledgement receipt can be downloaded for future reference.

Admission Session 2025 - 26 Started

Admission Open for the July, 2025-26 session for the notified programmes offered in Online modes on the universities” official website.

Admission Procedure Step by Step Process

Create your account on the university’s official admission portal to begin the application process.

Fill in your personal, academic, and professional details accurately in the online application form.

Upload scanned copies of required documents such as ID proof, mark sheets, and photographs.

Pay the application or admission fee securely through the official online payment gateway; ensure that you are on the university’s official website before making any payment.

The university will verify your submitted details and documents for eligibility.

Receive confirmation of your admission via email or SMS along with enrollment details.

Online MBA vs Regular MBA: Quick Comparison

| Feature | Online MBA | Regular MBA |

| Flexibility | ✅ Very High | ❌ Limited |

| Fees | ✅ Affordable | ❌ Expensive |

| Location Dependency | ❌ None | ✅ Campus-Based |

| Class Schedule | ✅ Self-Paced | ❌ Fixed Timings |

| Global Networking | ✅ Available | ✅ Available |

| Recognition | ✅ Industry-Equivalent | ✅ Recognized |

The Online MBA degree holds the same value as an on-campus MBA. It is valid for government jobs, private sector employment, and is recognized globally, provided it is UGC-approved.

Why Choose Online Universities for an MBA in Banking and Insurance?

Online universities with national recognition have been serving students globally since the 1980s. These institutions are approved by the UGC-DEB and accredited with a NAAC A++ grade, making them highly credible and trustworthy. Many of these universities offer over 200 academic programs and have earned the confidence of more than 7 million learners worldwide. They are widely recognized as pioneers in the field of remote and online education, offering quality learning opportunities to students from all backgrounds…

Learning Management System (LMS) – Most online universities leverage a robust Learning Management System to deliver their MBA programs. Through the LMS, students gain access to digital course materials, multimedia content, live and recorded lectures, and tools for assignment submissions and exam schedules. Discussion forums and faculty interaction features are also available, making it a fully interactive and student-centered platform.

Classes – Classes for the Online MBA in Banking and Insurance are conducted entirely online, featuring a mix of live interactive sessions and pre-recorded video lectures. Universities also offer audio-visual content, webinars, and online counseling to ensure student engagement and concept clarity. This approach allows students to learn at their convenience from anywhere.

Assessments – Student evaluation in this program is done through a combination of assignments, projects, online quizzes, case studies, and exams. Both internal and external assessments are considered, with each component contributing to the final grade. The exact assessment pattern may vary by university, so students are advised to check their institution’s assessment guidelines.

Examinations – Exams are conducted at the end of each semester, making a total of four examinations over the duration of the course. These exams are typically held online, with students required to pay the exam fee through the university’s portal. It’s important to note that assignment submissions are mandatory to be eligible for the exams. All relevant dates and exam formats are usually available on the official university website.

Career Opportunities – Graduates of the Online MBA in Banking and Insurance can pursue a wide range of roles, such as Equity Manager, Insurance Claims Advisor, Banking Executive, Business Consultant, and Investment Banking Associate. These roles are available in both national and multinational financial institutions, and often come with competitive salary packages, especially for graduates from UGC-approved universities with strong academic performance and relevant skillsets.

Why Choose? – Online MBA programs offer several benefits, making them a preferred choice among learners today. These include earning a UGC-approved degree, learning through an updated and industry-relevant curriculum, accessing high-quality study materials, and enjoying a flexible and affordable academic experience. These advantages make online MBA courses especially ideal for working professionals, career switchers, and learners looking for growth without compromising current responsibilities.

Regulatory Authorities

Stay informed about recent developments in regulatory authorities overseeing various industries, including finance, education, healthcare, and technology. These updates cover policy changes, compliance guidelines, new regulations, and government initiatives…

| AICTE | 1 link here |

| NIRF | 2 link here |

| BCI | 3 link here |

| NCTE | 4 link here |

| RCI | 5 link here |

| ICAR | 6 link here |

| PCI | 7 link here |

| NMC | 8 link here |

| CA | 9 link here |

| Ministry of AYUSH | 10 link here |

| DCI | 11 link here |

| INC | 12 link here |

| NAAC | 13 link here |

| AICPE | 14 link here |

| VCI | 15 link here |

| Central Council of Indian Medicine | 16 link here |

| Ministry of Culture | 17 link here |

Are you ready to take the next step in your career ?

Frequently Asked Question About Online MBA In Banking and Insurance 2025

The program can be completed in 2 to 4 years, depending on your pace and the university’s policies.

Yes, fee payments are accepted only through online modes, only at university official website.

Career opportunities include roles such as Banking Executive, Insurance Advisor, Investment Analyst, and more, depending on your skills and experience.

Yes, universities like Shoolini University Online and Amity University Online offer an MBA in Banking and Insurance with excellent academic infrastructure and placement support.

Absolutely. As per UGC guidelines, an online MBA from a recognized university is fully valid for both job opportunities and further studies.

Disclaimer

edigitaluniversity.com is a free educational information platform designed to assist students in exploring and selecting to educational programs. Students apply directly to the universities or institutions of their choice, and all admission-related and post-admission procedures are conducted solely between the student and the respective educational institution…..

This platform does not collect any fees or provide educational services. Its sole purpose is to connect prospective students with educational institutions that may align with their interests. edigitaluniversity.com does not assume responsibility for any job guarantees, placements, or employment assurances that may be claimed by any educational institution. All such claims, if made, are the responsibility of the respective institution.

The content, images, blogs, and other materials available on edigitaluniversity.com are for informational purposes only and are not intended to replace or represent any official offerings or commitments made by educational institutions. This platform may include links to external websites or third-party resources for convenience and informational use. We do not have control over the content, nature, or availability of these external sites, and their inclusion does not constitute an endorsement or recommendation of the views or information presented therein.